Prime Minister Islamic Republic of Pakistan

Pakistan is celebrating the International Customs Day on 26th January, 2017 to acknowledge the valuable contributions of customs officials and agencies for enhancing border security and safe movement of goods in order to preserve economic interest of their respective countries.

The day also provides us with the perfect opportunity to review Pakistan Customs’ efforts towards the enforcement of national and international laws relating to cross-border trade, control of illicit trafficking and collection of national revenues. It is an opportunity to reaffirm our commitment that Pakistan Customs will follow the international best practices of trade facilitation, transparent transactions and a more conducive business environment without jeopardizing its primary function of border controls.

This year’s theme, ‘Data Analysis’ with the slogan ‘Data Analysis for Effective Border Management’ is very pertinent in the modern digital world. I am confident that with the launch of WeBOC and other automation projects, a substantial amount of data is now available to the customs authorities for making more informed decisions. In an integrated world, efficient border management is one of our greatest challenges. This challenge can be met only through comprehensive data analysis and information sharing for more effective and rational employment of resources.

I felicitate Pakistan Customs and the Federal Board of Revenue on the efforts made so far for enhancing automation and development of a reliable database. It is now important that these efforts for efficient data collection and analysis are capitalized upon, leading to more targeted control over movement of goods across borders and facilitation of legitimate trade. This will contribute in expanding Pakistan’s share in international trade.

This year’s International Customs Day signals the onset of the World Customs Organization (WCO)’s year of “Data Analysis” with the slogan “Data Analysis for Effective Border Management”. Data Analysis is an important element in the Customs modernization process, aimed towards achieving efficient service delivery, eradicating corruption and securing revenue through effective controls at international borders.

It is indeed encouraging that Pakistan Customs has already made significant headway towards automation of clearance processes. With the launch of the automated Cargo Clearance System (WeBOC) across Pakistan, not only has dwell time for cargo clearance reduced considerably with a corresponding fall in the cost of doing business, but customs authorities now have access to a more reliable database. This voluminous data is, however, useful only if it is handled effectively for targeted risk management, enhanced performance measurement of customs officials as well as for research. Data analysis can, thus, play an essential role in the core Customs’ objectives of revenue collection, border security and trade facilitation through improved predictability and transparency in Customs operations. Establishment of the envisaged Electronic Data Interface with Afghanistan and China would place further data at the disposal of Pakistan Customs for analysis and comparison.

In today’s world of rapid globalization, the international trade scenario has changed drastically, demanding not only dialogue between international jurisdictions but also sustainable partnerships with the business community. All this is achievable only if comprehensive data analysis becomes a regular feature of our Customs administration. I hope, therefore, that Pakistan Customs and FBR continue on the path to reforms and modernization for more effective enforcement of border controls without compromising on trade facilitation.

Finally, I would like to congratulate all the officers and officials of Pakistan Customs on International Customs Day!

Customs fraternity, including Pakistan Customs is celebrating International Customs Day on 26thJanuary, 2017. I extend my profound felicitations to all officers and officials of Pakistan Customs on this special day.This year International Customs Day heralds the launch of World Customs Organization(WCO)’s theme of “Data Analysis for Effective Border Management”. It is an acknowledged fact that borders divide and Customs connects. However, for dealing with multi-faceted and complex challenges at regional and international level, it is imperative that the borders are effectively managed by ensuring implementation of effective and efficient controls and checks on the movement of goods as well as people. This is not only crucial within the country but also across the regional and continental contours.

The huge influx of trade and passenger traffic calls for greater vigilance and effective management of all borders. It is, therefore, crucial to broaden the horizon, enhance the commitment and improve the efficiency of Customs administration through better performance, transparency and development of new techniques, simplification of processes and putting in place intelligible systems to cope with the variety of challenges and complexities. Therefore, WCO’s theme for this year, “Data Analysis for Effective Border Management” is the fulcrum to define the role of Pakistan Customs in managing this gigantic task.

Needless to say that, this necessitates cooperation amongst various government departments/agencies, trade community including public to exchange data/information with Customs Department for effective enforcement and risk management to thwart any potential threats to the country’s economy.

Federal Board of Revenue is highly mindful of the fast changing trade dynamics and enforcement challenges. Hence, it keeps on enhancing capacity of its human resource, professionalism and innovation to address the challenges in an effective manner. As in previous years, I am fully convinced that Pakistan Customs will rise to the occasion and with full commitment actively take the “Data Analysis for Effective Border Management“ theme forward with full commitment and ensure the protection of the borders of our mother land, Pakistan, from all evil eyes.

The role of Customs, over the past decade or so, has diversified and transformed. Customs has an integral role in the globalization process and is a catalyst for competitive forces across the globe. Customs is not only the collector of state revenue, but it is regarded as a key border agency responsible for all transactions related to issues arising out of border crossing and it undertakes functions on behalf of all other national agencies. The management of borders has been one of the cardinal functions of the state. However, the management of borders has now become a very challenging and multifaceted process due to massive globalization, which has brought about fundamental changes in Customs activities and inspection processes the world over.

In view of the changing dynamics of global trade and to underscore the critical need for collecting and analyzing data to more effectively enforce controls, while extending facilitation to legitimate international trade, World Customs Organization (WCO) has chosen the theme “Data Analysis” with the slogan of “Data Analysis for Effective Border Management” for this year’s Customs Day.

While international trade is the lifeline of the global economy, it also attracts illicit activity. Effective data analysis, through cognitive systems, allows Customs authorities to pursue enforcement without jeopardizing trade facilitation. It enables the sifting of huge amounts of data to identify and investigate cases of non-compliance and it helps to make more accurate predictions about the evolution of fraud practices. Customs administrations are thus able to make intelligent decisions, thereby rendering systems of trade more efficient and safer without adversely impacting trade facilitation.

In the end, I congratulate all officers and officials of Pakistan Customs on this special day with the hope that the department shall continue in its resolve to achieve revenue targets, facilitate international trade and passenger traffic, along with effective border control through efficient data analysis, real time exchange of information and better inter-agency cooperation.

As member of the international Customs fraternity, Pakistan too is celebrating International Customs day on 26thJanuary, 2017 – an occasion to highlight the efforts of the Customs administration in the realization of government revenue, encouragement of international trade and enforcement of border controls to ensure security of global supply chain and combating transnational organized crimes.

WCO which is the premier body of 177 member countries provides leadership, guidance and support to Customs administrations in order to secure and facilitate legitimate trade, realize revenues, protect society and build capacity across all customs administrations around the globe. The WCO is dedicating 2017 to promote data analysis under the slogan of “Data Analysis for Effective Border Management”. Thus, the WCO members including Pakistan will have the opportunity to showcase their efforts and activities in a sector that is becoming a key element in customs modernization process: collecting and analyzing data in order to reinforce customs controls on sea ports, airports and land boundaries.

Since Customs administrations around the world interact with global supply chains, best international practices need to be adopted to ensure seamless movement of goods across borders. This is enabled primarily through automation – a good example being Pakistan Customs’ indigenously developed cargo clearance system, WeBOC.

Pakistan Customs has always remained in the forefront in the fight against illicit trafficking of goods, thereby contributed to the national exchequer and guarded our international borders. Taking into account the vibrant and dynamic role of Pakistan Customs over the years,I am confident that it will take the theme of WCO forward by utilizing all skills, expertise and resources to further secure our economic frontiers from all overt and covert challenges.

While felicitating the officers and officials of Pakistan Customs on this auspicious occasion, I expect them to continue to strive for greater professionalism in line with international best practices, to enable them to take intelligent enforcement decisions on the basis of information sharing and focused data analysis.

It gives me pleasure to write a few warm sentences for the Customs Fraternity on the Eve of 26th January, 2017 “International Customs Day”. The Global digitalizing has brought remarkable changes in Customs Operations worldwide in data collection and its subsequent analysis. The WCO has rightly dedicated the year -2017 for promotion of data analysis under the slogan “Data Analysis for effective Border Management” in order to make this earth a place where peace and tranquility ; safety and prosperity may reign supreme .

Globalization is inescapable and resulting in an increasingly complex world. The world is interconnected as reflected by expanded flows of goods, people, capital, information and technology. It is becoming easier to conduct business internationally. This provides countries with opportunity to fast–track economic growth and development through increased international trade. Globalization is not only beneficial to legal trade but it is also providing an opportunity for illegal trade as criminals across the world are also benefitting by more integrated markets and free movement of people, goods and money across the international borders. These developments sometimes ensue complexities and risks. The lack of effective controls in such risks may undermine gains that have been achieved. This backdrop has engendered an active response from the World Customs Organization (WCO) which has devised an action plan for Global trade facilitation coupled with utmost security. Hence, the WCO has dedicated this year’s International Customs Day under the slogan “Data Analysis for Effective Border Management”

The geo-strategic position of Pakistan calls for effective border management and Pakistan customs has always been front line agency for effective border management of our mother land. Customs is no longer only a collector of state revenues at border but is also responsible for administering international trade as well as securing the economy and society viz-e-viz cross border movements of both goods as well as passengers. The WCO provides leadership, guidance and support to the customs administration so as to secure and facilitate legitimate trade, realize revenues, protect society and build capacity. Pakistan being an active member of WCO is committed to modernize Pakistan customs according to the International standards and global best practices.

Pakistan Customs has already started making rapid stride in modernization process viz-e-viz “Collection & Data Analysis”. The indigenously developed software of “Web-based One Customs system” is a jewel in the crown of Pakistan Customs which is a huge repository of data with built-in analysis techniques. Furthermore , Pakistan Customs in collaboration with “Asian Development Bank “ have launched “Integrated Transit Trade Management System” to be fully operational at three border stations namely, Torkham, Chaman, and Wagha .-A giant leap forward in land Border management with three neighboring countries . Currently, Pakistan Customs has launched two software in order to have effective border Management at all International Airports; “Advanced Passenger Information system” for Air passenger traffic control & “Currency declaration software” for money flow into and out of the country.

I wish all the best to Pakistan Customs Community on this special occasion of International Customs Day and hope that it will leave no stone unturned for effective management of all borders of our homeland INSHALLAH. May ALLAH almighty grant us more and more success in the upcoming times and bless our beloved country with a robust and a healthy economy, Ameen.

Today, the Customs fraternity around the globe is celebrating International Customs Day under the umbrella of the World Customs Organization (WCO). The theme chosen for this year’s International Customs Day: “Data Analysis for Effective Border Management”, not only highlights the importance of information sharing for effective border management, but is the hallmark of efficient Customs enforcement through targeting and risk profiling.

Customs is in fact the first line of defence against illicit movement of cargo across borders. The role of Pakistan Customs is fast transforming from a mere revenue collecting agency to a dynamic enforcement agency against illicit movement of import and export cargo across international borders, thereby safeguarding the global supply chain security.

Pakistan Customs is dynamically leading modernization and connectivity in a rapidly changing world. It is also an axiomatic fact that borders divide, Customs connect since borders are synonymous with division, the main challenge for Customs administrations is to identify and pursue the best methods to increase connectivity which refers to people to people, institutional and information linkages that underpin and facilitate the achievement of objectives. However, effective border management is increasingly becoming a daunting task due to complex endogenous and exogenous threats and challenges. Pakistan Customs, being cognizant of this enormous challenge, has embarked on its flagship project, titled “Integrated Transit Trade Management System” (ITTMS), which not only envisages infrastructural improvement, but bolstering inter-agency coordination and using data analysis for robust targeting and risk profiling to maximize trade facilitation without compromising regulatory controls.

On this occasion, I would also like to thank a host of International Development Partners including the World Bank, Asian Development Bank, USAID, JICA, UNODC, USCBP, HSI, DFID, GIZ, IFC, etc. Without their technical and material support, it would have been difficult for us to attain the present level of advancement.

In the end, I sincerely felicitate Pakistan Customs and the global Customs community on the occasion of International Customs Day and hope to work in close coordination with each other to achieve the common objective of safeguarding our economic frontiers against illicit trade.

Border management is one of the biggest challenges of our times and Customs administrations all around the world are facing it with appropriate response. The efficient and effective border management ensures security and smooth trade flow – import,export and transit of goods. The generally accepted mission of Customs administrations world over is to design, develop and implement such integrated policies and procedures that ensure increased safety and security as well as effective trade facilitation and revenue collection for the state. This aim is better achieved through appropriate use of information/data analysis in dealing with cross border movement of goods, conveyances, and people. It is against this backdrop of increasingly globalized world that the World Customs Organization (WCO) has dedicated this year theme “Data Analysis for Effective Border Management.” The promotion of data analysis by WCO is aimed at developing border management strategy built on proactive decision making. If the borders are well managed then the results could be reduced documentation, speedy clearances of goods by eliminating delays, lowering of cost of doing business, economic growth and ultimately to reduce poverty and increase prosperity. In line with WCO’s present theme, Pakistan Customs is already using this model of “Collection and Analysis of Data” as an integral part of Customs Modernization process for better border management/clearance of goods for import, export or transit since the introduction of Pakistan Automated Customs Clearance System (PaCCs) in 2006 and Web-based One Customs (WeBOC) in 2012.Among World Customs administrations especially in the regional context Pakistan Customs has taken a lead by introducing and successfully operating WeBOC for real time clearance of cargo. This is an automated clearance system providing end to end solutions for both imports and exports. The pace of trade across the border has reached a new height with this technological advancement achieved by Pakistan Customs.Pakistan Customs’ Reforms & Automation Directorate is continuously improving and offering this platform to various ministries and departments and progressing towards main objective of “National Single Window” for all stakeholders. The WeBOC development team is now developing module for Advance Passenger Information System (APIS) after signing MOU with IATA. This will capture data of incoming and outgoing passengers and help Pakistan Customs in analysis of passengers’ data and take enforcement action against khepias, drug traffickers, currency plus gold smugglers, etc.

The data analysis is helping Pakistan Customs to achieve new levels of success in facilitation for bona fide trade/passengers and controlling illegal trade/suspicious passengers. The data analysis is thus greatly supporting the core Customs’ objectives of revenue collection, border security, collection of trade statistics and trade facilitation. As the reforms in Pakistan Customs are going on the same would further strengthen the culture of collection and analysis of data for further trade facilitation, revenue collection, meeting the national targets of economic growth and prosperity.

Pakistan Customs is therefore fully determined and devoted towards the protection of national borders in line with best and modern global customs practices. I congratulate the world customs fraternity in general and Pakistan customs in particular on this special day of great significance and importance.

Have a very joyful International Customs Day!

Message from Customnews.pk

World Customs Organization (WCO) is observing World Customs Day on January 26th under the theme ‘Data Analysis for Effective Border Management’ with a view to promote importance of recording patterns of trade, passenger movement to preempt violation of border sanctity.

Recent developments involving transit and economic corridors in the region have opened up opportunities and even greater challenges for Pakistan.

Pakistan’s land border stations and sea ports have strategic importance thus immense potential as transit corridor and as regional transit hub.

However, there are several shortcomings on the part of authorities, which leaves Pakistan far behind in the line of technologically updated border management service.

Data recording and subsequent analysis can be the most efficient tool in trade facilitation, enforcement of border/customs laws as well as revenue collection. Unfortunately, the sources of data available to authorities are not completely reliable, the efficient analysis capability is also questionable.

Data is collected on the basis of Goods Declarations (GDs) filed by the importers or their agents, which is then analyzed. The random examination of the consignments often leads to detection of different violations such as misdeclaration pollutes the collected database making the analysis difficult.

On the other hand there is a tendency on the part of examining authorities who abuse the process of data collection again jeopardizing the accuracy of the data.

Shortage of trained staff and equipment is another issue which hinders efficient data collection. The Directorate of Reforms and Automation is short of skilled personnel and regular Customs staff is running this high-tech department.

There have been cases where shipper, shipping agent and importer formed a nexus to defraud the system and over-ride the data to their common advantage. The inefficient risk management system has enabled inaccurate and engineered profiling of importers. Due to this flaw, the profile of importers committing violations of law through mis-declaration or under-invoicing and evasion through misuse of concessionary SROs remains intact and they keep abusing the green channel facility.

Pakistan share long and porous borders with Iran and Afghanistan, which are the source of smuggling and duty evasion. Because of large influx of smuggled goods, the data can not be accurate.

However, there are certain potential impediments to an optimal use of data such as the lack of qualitative data, data that has been integrated or merged, lack of harmonization of data across border agencies lack of skilled resources, IT challenges and cultural challenges. In addition it is vital that appropriate privacy and confidentially law be respected.

Pakistan Customs Appraising Officers Association

Pakistan Customs Appraising Officers Association is observing World Customs Day on January 26, 2017 and committed to facilitate trade and promote digitization to ensure complete compliance of the mandate accorded to Customs.

The WCO announced that 2017 will be dedicated to promoting data analysis under the slogan “Data Analysis for Effective Border Management”. WCO Members will thus be called upon to further promote their efforts and initiatives in a sector that is becoming a key element in Customs modernization process: collecting and analyzing data.

There is a need to cope with the changing developments in international trade and Customs has devised a well planned strategy beginning with the development of a skilled human resource and modern cargo clearance system which is the most important element of development process. In line with this, Pakistan Customs has modernized its procedures and processes to keep up with development in trade and international customs agreements.

On the auspicious occasion of International Customs Day which is celebrated every year on the 26th of January by the World Customs Community across the globe, I extend my warm felicitations to all officers and officials of the Pakistan Customs. The Brussels based 177 member World Customs organization is celebrating its 65th anniversary this year. In this regard we are proud that Pakistan Custom is playing a key role in development of this progressive country through efficient targeted controls and the facilitation of lawful trade.

This year’s topic of discussion “Data Analysis for Effective Border Management” as announced by the WCO is an inclusive approach which will propel Customs to new levels of success in both compliance and facilitation by enabling it to improve risk management which supports enhanced detection of irregularities, illicit consignments, the suspicious movement of people & financial flows and the facilitation of legitimate trade. History enables us to predict behavior of the trade activities, engage with other government agencies to leverage their experience and expertise, conduct quantitative research for purposes of building knowledge, to enhance performance measurement to improve Customs practices and integrity.

Data analysis thus can greatly support the core Custom’s objective of revenue collection, border security, collection of trade statistics, and trade facilitation.

Pakistan Customs has always remained in the forefront of liberalization and rationalization of the trade regime and procedures in supporting government’s initiatives to facilitate and enhance trade with international partners. There are of course potential obstacles to an optimal use of data, such as the lack of qualitative data, data that has not been integrated or merged, lack of harmonization of data across border agencies, lack of skilled resources, I.T infrastructure and cultural challenges. In addition, it is vital that appropriate privacy and confidentiality of laws must be respected.

In such an environment, the task of customs agents is highly vital in helping the government to achieve an appropriate balance between trade facilitation and regulatory control. They provide services with high professional standards and ethical behavior between traders & custom authorities.

The Karachi Customs Agents Association is especially grateful to Pakistan Customs in general and WCO in particular for keeping us on their top agenda of training and learning. I wish to convey my best wishes to the Pakistan Customs on the International Customs Day.

On the precious occasion of 65th International Customs Day which will be celebrated on 26th of January 2017 by the World Customs Organization (WCO) and Customs administration all over the world, I extend my warm greetings and felicitations to all the Officers and officials of Pakistan Customs. There is no doubt that Pakistan Customs is playing a vital role in the betterment of our progressive country’s economy through effective targeted controls and the facilitation of legitimate trade.

The WCO announced that 2017 will be dedicated to promoting data analysis under the slogan “Data Analysis for Effective Border Management”. WCO Members will thus be called upon to further promote their efforts and initiatives in a sector that is becoming a key element in Customs modernization process: collecting and analyzing data. Customs has a substantial amount of data at its disposal, such as data submitted for the Customs clearance process. Customs can also collect & maintain database from other sources such as government agencies, commercially available databases, and open source information platforms such as digitized global public records and multilingual news sources. Moreover, with the innovation of technology, data records are now saved on the cloud arena and there is no need for storing physical records, further facilitating emergence of paperless environment and easy access to data across the globe.

There is a need to cope with the changing developments in international trade and Customs has devised a well planned strategy beginning with the development of a skilled human resource and modern cargo clearance system which is the most important element of development process. In line with this, Pakistan Customs has modernized its procedures and processes to keep up with development in trade and international customs agreements.

Pakistan Customs is one of very few organizations who pioneered in designing and automating their clearance and audit systems in the country. It is known fact that increase in trade volumes cannot be handled without state of the art clearance system and the department’s efforts in this regard must be appreciated. Introduction and upgrading of automated environment is indeed a remarkable achievement providing benefit to all stakeholders i.e. the Government, trade and industry.

Lastly, I would like to convey my felicitations to the entire Customs Staff who have worked hard through putting in extra efforts to ensure smooth flow of trade despite all odds. I strongly believe that together we will make Pakistan Customs the best service in the region.

Data analysis for trade facilitation and effective enforcement.

The growth in bilateral or multi-lateral trade is directly proportional to trade facilitation and effective enforcement. With the passage of time the trade of Pakistan with other countries is increasing and is expected to increase manifold.

The need of effective border management has never been so important in Pakistan’s perspective than today, especially in the aftermath of CPEC, framing of new free trade agreements, opening of Iran’s trade to world and business potential with Cental Asia and India.

Undoubtedly, the core to effective border management is system based data analysis. Such is the importance of the data analysis that customs world has decided to dedicate the slogan to it for the International Customs Day 2017.

From the regional perspective, if we observe, different systems are being used by customs for goods clearance.

In Pakistan, WeBOC is operational. In India, Iran and Afghanistan Asycuda system is working, whereas China has home grown system for custom clearances. For effective border management, the data sharing of the trading countries is of essential importance and in the absence of uniform systems, it is cumbersome to share and utilize the customs data.

Thus, the real challenge from Pakistan’s perspective, is the IT-based linkages for sharing data on real time basis to effectively check the issues of mis- declaration, under valuation, misclassification and illicit trade.

In the first instance, for effective border management based on data analysis, joint border facility by the border customs authorities of neighbouring countries may be initiated. However for ideal atmosphere, the Export GD of one country, should be treated as import GD of the importing country.

A parallel option, however, is that we consider following WCO Data Model. The WCO Data Model helps in meeting the procedural and legal needs of Customs for controlling export, import and transit transactions. It is consistent with other international standards such as the United Nations Trade Data Elements Directory (UNTDED).

The WCO Model not only includes data for different customs procedures but also information for the cross-border release and clearances.

In our environment, WeBOC is a Single Window system as it allows the reporting of information by all government agencies in one system. The adoption of WCO Data Model will help us in effective border management as well as enhancement in revenue together with effective and timely handling of misdeclarations, under valuation, illicit trade, smuggling and money laundering.

- Now that Pakistan Customs has entered in to the age of digitisation, how is Pakistan Customs coping up with the rapid developments?

Dr Saifuddin Junejo: Pakistan Customs has been at the forefront of all public sector organizations in Pakistan when it comes to automation and adoption of technology. We have gone through rigorous business process re-engineering leading to fewer steps required in our day to day processes bringing ease of doing business with us and at the same time creating transparency. We have used automation for better controls without compromising facilitation of trade.

When the manual system was in vogue it took dozens of steps to complete a Goods Declaration (GD) and it took days to get the goods cleared. After adoption of automated procedures almost 35 percent of cargo is cleared with minutes and nearly 65 percent cargo is cleared same day by Pakistan Customs. This has been made possible by first implementing PaCCS back in 2004 and subsequently making WeBOC in 2011, our indigenously made automated Customs clearance system.

We are also in the process of developing Advanced Passenger Information System in collaboration with IATA for passenger profiling at the airports. Needless to say we have adopted digitization with open arms.

- CPEC has already got the attention of half of the world, what is going to be its impact on Pakistan Customs?

Dr Saifuddin Junejo: Pakistan Customs is the guardian of the economic borders of Pakistan therefore it will be at the forefront when it comes to CPEC. The movement of cargo will be handled and monitored by Pakistan Customs using its automated system and well trained staff to make sure all CPEC cargo gets priority and is handled in the most professional manner.

Up-gradation of Sost border Customs station and Gwadar Customs station is well underway and with the roll out of WeBOC system at these stations we are confident CPEC cargo will be handled properly. I would like to add that Pakistan customs has devised a long term strategy for enhancing border trade with all our neighbors.

In this regard FBR has embarked on the implementation of ITTMS a very forward looking project which will bring all the border managing agencies under one roof in an automated environment. Initially these modern Border centers will be created at Torkham, Chaman and Wagha with initial investment of $300 million, surely ITTMS will be extended to other border Customs stations including Sost and Gwadar. Implementation of CPEC will result in the creation of more dry-ports across the country, creation of Special Economic Zones (SEZs), expansion of marine enforcements and this will result in an overall expansion of Customs as an organization.

- The theme for the International Customs Day this year is “Data Analysis for Effective Border Management”. How is Pakistan Customs planning to show its participation?

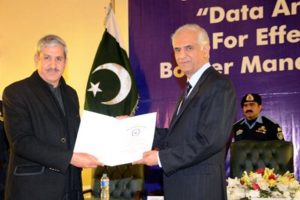

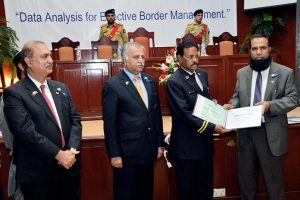

Dr Saifuddin Junejo: As always Pakistan Customs will celebrate International Customs Day with fervor and zeal. All Customs stations will be celebrating Customs Day by conducting our traditional events such as flag hoisting and parade at all Customs stations, destruction of liquor and other contrabands and awarding performance certificates and awards to officers and staff, holding of seminars and issuance of supplements in leading newspapers of the country. Going with the theme this year we will highlight how Pakistan Customs has adopted automation and usage of data analysis in cargo clearance. We have adopted data analysis for risk profiling and better assessment and examination of cargo. Decreasing dwell time and increasing revenue collection is a testament to our effective and efficient usage of data.

- How does Pakistan Customs deal with mass amounts of shipments?

Dr Saifuddin Junejo: Trade volumes have been increasing annually and the trend seems to stay strong in the coming years. Efficient Customs administration is essential for handling the increased trade and Pakistan Customs has evolved with the requirements of the times by adopting automation for clearance of cargo and facilitating international terminal operators to put up state of the art terminals.

Dubai Port World and Hutchinson’s are some of the leading port operators of the world which also handle cargo in Pakistan.

Pakistan Customs has introduced risk profiling to examine a limited number of containers unlike previously when there was 100 percent examination, similarly risk profiling is used in clearance of almost 35 percent cargo through the green channel resulting in clearance of cargo within minutes. Pakistan customs staff is available round the clock 24/7 seven days a week at ports for expediting clearance of cargo.

- Any message on the International Customs Day?

Dr Saifuddin Junejo: I congratulate profoundly all customs administrations in general and Pakistan Customs Service in particular on this august International customs Day and take an opportunity to remind the Pakistan Customs of the challenges in the discharge of its duties in the massively globalized world. I would further emphasize that globally the Customs administrations are moving from the role of revenue collection to enforcement to the extent of including security diversion as well, we in Pakistan need to transform Pakistan Customs role to gradual and greater enforcement. Let’s work towards that end.

Data Analysis: A tool for Customs Enforcement

In the contemporary world, governments are under pressure to perform more efficiently and effectively. Revenue administrations are no exception, as they have to balance the decreasing resources and ever-increasing risks, often in difficult economic circumstances.

While the traditional methods for managing risk had, served the authorities well, the increasingly complex trading environment and concomitant growth in the regulatory framework, has made it incumbent upon them to seek more advanced methods to combat fraud and wasteful resource allocation.

To effectively deal with this scenario, customs administrations are turning to data analysis for improvement in their business processes, resulting in better compliance management and enhanced service delivery. The significance of the data accumulated through Customs clearance applications is important as it covers modes of transportation, frequency of cross-border transaction (both travel and importation), value and source of goods which in combination with information from other agencies can enable customs to look beyond the singularity of the transaction and actually view the profiles of companies, industries or countries.

Since Customs data is based on the globally accepted classification and coding system (HS code), it is particularly convenient to profile changes in industrial behavior as well as macroeconomic analysis. Such datasets can also enable customs to identify anomalies that are indicative ofcommercial fraud or unethical conduct. On the other hand data collected through the Customs clearance applications e.g. WeBOC, ASYCUDA etc. is of great value to other government agencies that are also involved in border activities e.g. transnational organized crime, human smuggling, money laundering etc., just to name a few.

Such agencies can use trade and traveler data to improve their enforcement and compliance levels. However, while customs data is a strong enabler, its linkages with nationally available datasets such as PISCES & IBMS (FIA), national biometric record (NADRA) can substantially enhance the ability of border agencies to effectively tackle the earlier mentioned criminal activities. On the other hand inability to acquire data analysis capabilities would render organizations ineffective in the modern world where regular trade channels are now being used to launder ill-gotten proceeds to safer havens and destinations (acquired through commercial frauds, criminal activities etc).

To achieve absolute compliance through traditional enforcement methods would not only require resources that governments would not be willing to provide but would entail delays and costs to industry that the public would not permit.

In the background of an automated business process, data analysis provides a viable alternative approach to achieve unprecedented and previously unattainable levels of compliance and facilitation. Pakistan Customs has initiated a number of pilot studies for adopting different data analysis tools.

The goal is to empower the organization by developing control dashboards (at the front-end) that allow for intelligent or evidence-based decision making to all operational tiers of the customs hierarchy. At the back-end of the application would be the data-warehouses/marts that would drive the Business Intelligence (BI) tool using different enterprise level tools e.g. ETL, OLAP etc for continual data analysis in real time vis-à- vis the evolving threat/risk environment.

In addition development of the IATA API / Cargo XML interface (betweenWeBOC / Airline systems) would make available advance passenger/Cargo information to Pakistan Customs enabling enhanced targeting of travelers involved in trafficking, fraud, money laundering etc.

In conclusion, data analysis is a force multiplier as it provides a powerful strategic tool to policy makers for deploying resources and establishing priorities to those problems and opportunities that will produce the most significant results.

It places in the hands of the individual customs officer information and perspective oncustoms issues and problems that is international in scope. In the mass of “bigdata”, it allows for a structured approach to data analysis for achieving organizational objectives and brings order to the chaos.

Data analysis is the springboard that boosts customs to new levels of efficiency and effectiveness in the increasingly complex and demanding environment of the international trade supply chain.

The increased trade volumes have necessitated the use of self assessment system duly supported through automation. For that, the under clearance cargoes are divided into low high and medium risk categories, determined through deployment of elaborate risk management methods. The backbone of such automated clearance systems is a robust post clearance audit to verify the accuracy and authenticity of self declarations.

Pakistan was the founding member of Customs Cooperation Council, which later on gave birth to World Customs Organization (WCO). One of the leading covenants of WCO i.e. the Revised Kyoto Convention (RKC) mandatorily requires its member to include audit based controls in their Customs procedures. Another essential requirement of RKC is evaluation of traders’ commercial systems by Customs administration to ensure traders compliance with Customs requirements.

In order to fulfill the international obligation, the Directorate General of PCA was established in October, 2008, with the primary objective to improve trade facilitation and to minimize potential revenue loss. While ensuring that the national and international trade controls, prohibitions and restrictions are being duly observed, the Directorate General of PCA also contributes in educating the stakeholders to improve their level of compliance with international best practices of WCO as well as of WTO. The Directorate General of PCA also gives invaluable input for the improvement of the systems and controls at the clearance level.

Instead of focusing on mere detections, the vision and mission of Directorate General of PCA is to broaden the audit coverage of the custom clearance, the detections become only consequential. The Directorate General of PCA believes that the percentage of audit coverage provided over a time-period should be the performance yardstick; input for policy and procedural corrections is another.

With that objective in mind, The Directorate General of PCA is committed to contribute positively towards overall improvement in the efficiency and effectiveness of Pakistan Customs / Federal Board of Revenue.

Performance Review:

The input for audit by PCA at present is contributed by three streams of information i.e. (a) Examination of data from one-custom/WeBOC server on the basis of professional knowledge and experience at Headquarters as well as Directorate (b) Complaints and (c) Special Assignments from FBR.

Considering the limited resources of man and material to process the information gathered thorough these sources, the obvious spike in the performance of the Directorate of PCA, Karachi, as illustrated through following Table and Chart, is commendable.

| S No | Year | Amount of duty and taxes |

| 1 | 2012-2013 | 7.4 |

| 2 | 2013-2014 | 40 |

| 3 | 2014-2015 | 1010.51 |

| 4 | 2015-2016

(Jul 2015- Jan 2016) |

2267.28 |

| 5 | 2016-2017

July 2016 – Dec 2016 |

1600.00 |

CPEC and Gwadar deep sea port to change face of pakistan

China Pakistan Economic Corridor (CPEC) is fast becoming life line for Pakistan. The size of the CPEC has been increased to more than $55 billion after China agreed to upgrade the main railway line from Karachi to Peshawar at a cost of $8 billion.

Major portion of CPEC program will be spent on energy projects to ensure Pakistan enters new era in a bright and enlightened environment. Though the whole of Pakistan and each and every individual of this country will benefit from CPEC many major and less developed areas of Pakistan will be direct beneficiaries of the economic activity generated by this project.

From Khanjerab to Gwadar three main routes will connect the whole of Pakistan to CPEC. These corridors are Western Route, Eastern Route and Central Route. Western route among others may pass through Sust-Gilgit-Batagram-Mansehra-Abbotabad-Kala Bagh Hassn Abdal-D.I.Khan-Zhob-Qilla Saifullah-Quetta-Sorab-Bisma-Hosab-Turbat- and Gwadar.

Eastern Route among others is likely to cover Sust-Gilgit-Bataagram-Mansehra-Abbotabad-M2 to Hassan Abdal-Faisalabad-Multan-Sukkar-Shadad Kot-Khuzdar-Basima-Hosab-Turbat- and Gwadar. Multan to Lahore and then M2 is also included in Eastern route.

Central Route may find its way, inter alia, from Sust-Gilgit-Batagram-Mansehra-Abbotabad-Hassan Abdal-Mianwali-Layyah-D.G Khan-Jacob Abad-Ratho dero-Khuzdar-Basima-Hosab-Turbat- to Gwadar.

These routes are not mere roads linking different cities to the Gwadar Free Zone and deep sea port, they will open new vista of economic opportunities to the locals and others in the region. Many special economic zones and tax free zones can be set up on these routes which will create a number of jobs and give impetus to the much awaited double digit GDP growth of Pakistan.

Unfolding of CPEC benefits can reverse the brain drainage of Pakistan i.e., not only those who left Pakistan due to non-availability of job opportunities may return to find this country more lucrative, but also many highly qualified foreigners will reap economic incentives of CPEC.

Throughput of Karachi port and Port Muhammad bin Qasim is not enough to handle shipping activities of Pakistan. This efficiency will come through Gwadar deep sea port and the designated western, eastern and central routes of CPEC.

To facilitate trade through Gwadar Port a full-fledged Model Customs Collectorate was notified by the Government of Pakistan in 2007 which became fully functional in 2011. This Collectorate is the guardian of 640 kilometers coastline of Balochistan, 350 km of Pak-Iran border and almost 100,000 square kilometers of the province.

Establishment of a Customs Collectorate in Gwadar is bearing fruit and tax compliance in this area has gone up massively; rather growth wise it might have been the best in Pakistan when we look at the revenue figures of the collectorate.

Looking at the unfolding benefits of CPEC, we can say, the dream of every Pakistani to be recognized as a respected citizen of Pakistan in the world is coming true. We are rightly pinning our hopes on the success of CPEC and looking forward to the days when prosperity, liveliness, pride, attraction, solace and peace will replacepoverty, chronic stream of worries, despondency, extremism and terrorism in Pakistan.

Transforming WeBOC into Pakistan’s National Single Window

Since the early 1990s Customs administrations have been developing automated systems to improve trade facilitation and to achieve effectiveness in revenue collection. Advancements in information technology have enabled governments to make dramatic improvements in the service delivery. Each new development in IT brought with it a new set of possibilities bringing transformational changes to the regulatory environment for international trade. The emergence of the ”Single Window” (SW) concept is one such development and Customs being strategically well placed on the borders has assumed the lead role in implementation of single window in many countries.

“Single Window” is a new method of governance and service delivery in which traditional structures of government are revamped enabling citizens and businesses to receive government services through a single interface to government. The new structure is transparent to the consumers of the services, leading to increased efficiencies and reduction in the transaction costs of regulation.

In recent times, the term ‘Single Window’ has also become a slogan of Trade Facilitation and is now an obligation under the WTO Agreement on Trade Facilitation (TFA). The Trade is strongly in favour of a Single Window approach because it creates a simplified interface to Cross-border Regulatory Agencies in which, the entire government apparatus that deals with the movement of goods across borders is re-engineered to meet the specific service needs of business.

The definition of SW, as provided in the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT) Recommendation 33, is “a facility that allows parties involved in trade and transport to lodge standardized information and documents with a single entry point to fulfill all import, export, and transit related requirements. If information is electronic, then individual data elements should only be submitted once.” According to World Customs Organization (WCO) Guidelines on How to Build a Single Window Environment, the term ”Single Window Environment” is defined as a cross border intelligent facility that allows parties involved in trade and transport to lodge standardized information, mainly electronic, with a single entry point to fulfill all import, export and transit related regulatory requirements. The term intelligent is significant because the Single Window is not merely a data switch or a gateway to a set of facilities nor is it just a unified access point through a web portal. It is a facility providing shared services to the users. Computation of duties/ taxes, coordinated risk management, shared operational controls and orchestration of inter-agency business processes are some of the examples of shared services.

Relative to high income OECD countries, Pakistan performs better in terms of cost to export/import (USD per container) however, major improvements are required to reduce the number of mandatory documents and time taken to export/import consignments. Many countries have developed National Single Window system to overcome such obstacles in trade flow. These include USA, Singapore, Thailand, Indonesia and many other developed and developing countries. Realizing the importance of national single window in trade facilitation, the Federal Board of Revenue (FBR) has embarked upon a plan to implement Single Window in Pakistan in coordination with Pakistan Regional Economic Integration Activity (PREIA). Pakistan Customs WeBOC system being a fully automated computerized clearance facility operating successfully for more than 5 years having processed over 5 million import and export transactions to-date provides an excellent platform for building National Single Window in the country.

It is important to observe that achieving a national single window environment for Pakistan would be a long haul effort, requiring serious, devoted and sustained efforts. Since every country has its own trade regulatory structure, there is no ‘universal’ model to be replicated. Instead an ‘evolutionary process’ may be adopted using the existing WeBOC as the core around which would be layered the future National Single Window of Pakistan. The evolutionary concept of SW was confirmed and further detailed in the background paper of the Global UN Trade Facilitation Conference, “Ten Years of Single Window Implementation: Lessons Learned for the Future,” held in 2011 in Geneva, taking into account the global experiences made in the last 10 years. The evolution of the UNESCAP model SW implementation can be described in five incremental development levels which are: i) Development of a paperless customs declaration system ii) Integration of paperless customs with other regulatory bodies issuing trade/import/export/transit-related permits and certificates, and other related documents iii) Extension of the SW to serve entire trade and logistics communities within the airports, seaports, and/or dry ports iv) Creation of an integrated national logistics platform interlinking the administrations, companies, and the service sectors to better manage the entire chain of import-export operations v) Interconnection and integration of NSWs into a bi-lateral or regional cross-border e-information exchange platform.

For the development of Pakistan’s National Single Window Environment in a more systematic and structured manner, the following broad based recommendations have been framed to serve as milestones in a collective effort to achieve the goal. Foremost is to achieve political support and commitment at the highest level of the Government with effective monitoring, timelines and resource allocation. It would be important to declare Pakistan Customs as the lead agency for implementation of National Single Window. The alignment of legislation and risk management criteria of all regulatory agencies is also an important prerequisite. Pakistan Customs needs to adopt a proactive approach for up-gradation of WeBOC system and to engage all stakeholders for the requisite business process re-engineering to build an efficient, fully-automated, transparent and predictable facility for handling the country’s international trade.

Pakistan Customs: Pushing the borders out through data

World Customs Organization’s slogan for International Customs Day this year is “Data Analysis for Effective Border Management”.

The choice of this slogan is a crucial recognition of the inadequacy of traditional model of border management. Ever increasing flow of people and goods across international borders demands that the customs administrations all over the world start considering out-of-box solutions for problems relating to managing international trade.

It’s no more about frisking each and every passenger that crosses an international border or de-stuffing and examining every container that lands at your port. It’s about identifying and profiling goods and people prior to their arrival and thus ‘pushing the border out’.

The perennial dilemma faced by customs professionals all over the world is to find a balance between trade facilitation and ensuring the security of the international trade supply chain. Access to timely, accurate and actionable information can help customs administration all over the world to make informed decisions and overcome this dilemma to a great extent.

Pakistan Customs stands at the forefront of developing and executing risk-based clearance system. Its web based system for customs clearances processes both import and export related goods declarations and interacts with its users on real time basis. Pakistan customs started its automation drive as early as in year 1992.

However,a fully developed risk-based system of clearance was launched through the introduction of PACCS in the year 2005. Pakistan Customs automation effort came full circle with the launch of Weboc system in the year 2011.

Weboc is an indigenously developed system of clearance, which provides end to end solution for the customs related transactions. An extraordinary feature of the Weboc system is a cache of valuable historic data captured from the date of its operational launch.

This data is used in identifying and intercepting high-risk people, goods, conveyances, and commercial entities. It helps in identifying suspect transactions and also supports Post Clearance Audit function of Pakistan Custms. However there is a need for developing an ‘intelligence cycle’ as customs function moves away from static to more mobile and selective controls.

This cycle can only be developed if there is a system of inter and intra-agency data sharing. Pakistan Customs has launched a timely drive to bring other regulatory entities on WeBOC platform.

Most recent inclusion of data of foreign exchange transactions of importers and exporters in the Customs computerized clearance process has benefited Pakistan Customs by reducing the room for under invoicing.

It has also provided the State Bank of Pakistan (SBP) with a platform to perform its monitoring role in the flow of foreign exchange. In a recent drive for capturing foreign exchange related data, Electronic I-Form (EIF) module has been rolled out. Through this system, it has been made mandatory to submit EIF at the time of the GD filing.

There has also been a greater emphasis on data sharing among international Customs administrations as a means of effective border management to facilitate legitimate trade and to seize illicit goods. Pakistan Customs has upgraded its Electronic Data Interchange (EDI) infrastructure by acquiring cutting edge technology for exchange of export data with one of its largest trading partner China.

This is a major and timely development and aligns with Pakistan’s key role in the CPEC. Pak Afghan transit trade is also being managed between Pakistan and Afghan Customs through end to end data exchange.

While a lot has been achieved, there is a need to further broaden the database and to refine data analysis skills for making Customs risk management system more results oriented. Pakistan Customs welcomes WCO’s initiatives in helping to achieve these objectives and remains committed to developing synergies with its international trading partners for making the world a more secure and trade friendly place.

Data Analysis

What we do in our daily life from dawn to dusk? We process information. This is important for our survival and growth. Machines can help in all walks of life including information processing. What we do, machines can do it very fast; by no means better. In the present day Customs context, over the years, the volume of transactions has increased manifold, the complexity of individual transactions have also increased significantly owing to multiple tariff rates, concessionary and regulatory regimes, bi-lateral or multi-lateral agreements like FTAs, PTAs, EHs, administration of quotas of quantity and origin, diversity of specifications and incumbent classification and value related issues etc, just to name a few. Workforce, responsible for all this transaction processing could not be increased proportionately, therefore it is very important that the significance of data analysis is appreciated by Customs.

When there are so many things to look into, the probability of non-compliance, both voluntary and non-voluntary also increases. Today’s Customs administrations are dealing with this issue through increasing skill set of workforce, modernizing its systems of transaction processing through ‘business process reengineering’, institutionalizing RMS (Risk Management System) at organizational level, formalizing information and intelligence sharing with businesses, other government / regulatory authorities and other Customs administrations. Nothing is possible without ‘data analysis’. This is the blood flow which is the life line for almost all other organs.

Gradually and steadily the significance of data analysis is increasing especially at senior executive level. Understanding the nature of data – we get, we create, deal with, analyze, draw conclusions and take decisions and create further data – is important. In ordinary parlance data analysis would mean obtaining data, inspecting it to identify and remove distortions, normalizing it and applying one or more statistic or formula to convert the data into useable information which can be used in decision making. The job of an analyst does not start from data analysis per se but includes identifying channels which create distortions in data, making analyses futile and at time counterproductive. Distortions based on distortions will create more distortions in data and not address the anomalies. Officers frequently complain about distortions in the data, with minimal understanding that a significant portion of distortions have actually been introduced by processing and to some extent by monitoring officers themselves. Most common type of distortions in Customs clearance data include, but are not limited to, violations pertaining to ‘Unit of Measure’, incomplete / incorrect declarations/ specifications , incorrect claim of concessions and exemptions, etc. One example would clarify the position. FBR notified standard ‘Unit of Measure’ (UoM) through CGO 7/2006 dated June 26, 2006 whereby it was made mandatory to file declarations according to this CGO and the purpose was to facilitate the collection, comparison and analysis of trade statistics. Stakeholders, importers, third party brokers, and even processing officers have frequently ignored this standard without the fear of any sanctions. In spite of the fact that the clearance system was enabled to indicate correct UOM, while filing and processing quantity related declarations, other units of measure were given in the field of Item Description to hoodwink the automated clearance system. Processing and monitoring officers have all along been soft on the issue and could not prevail upon the trade to correctly indicate the standard UOM; for instance, against UOM of Kg, different units, like number, sets, gross, pieces, bundles, tonnes would sheepishly be declared in the UOM field. Contraventions on this aspect were not given the due attention, despite legislative support under SRO 499(I)/2009 dated 13, 2009. The end result is that data pertaining to a particular classification heading cannot be compared. It has also been noted that if the system identifies such transaction for compliance check, the processing officers, frequently would make adjustments in the per unit value to arrive at certain import value for the calculation of duty and taxes without correcting the unit value according to standard UOM and without realizing that this anomaly has far reaching consequences in the clearance system on two counts; the subsequent processing officer’s limits of discretions are increased on one hand, and system’s automating such transactions is compromised. Expectations of ‘garbage in, gospel out’ are not reasonable. Selectivity criteria, however, configurable will not be able to deal with such self created rather self inflicted anomalies. Distortions can be removed through inspections, applying sorting, dispersal analysis, trim-mean, Kurtosis (a measure whether there is a problem with outliers in a data set; larger kurtosis indicates a more serious outlier problem), expert judgment, besides others.

After removal of distortions data shall be normalized. The characteristics of data elements shall be known beforehand; data is examined to evaluate whether it is congruent to desired characteristics and if not, then knowing how to deal with it, for example formats and types are corrected. After normalization, data is ready for analysis. There are numerous tools available, many are built into the system and made accessible to processing officers as MIS reports. They can at the same time, get clearance data and run their own analyses for particular jobs or requirements. For the purpose MS office’s Excel or any similar applications can be used. Mostly frequency counts, circumambulations (as in Excel Pivot Tables), means, dispersal analysis, skewness, congruence analyses, range analyses, inferential techniques (work back methods), etc besides others are used by Pakistan Customs.

Keeping in view the current perspective, FBR shall take following steps;

- Training senior executives on data analysis so that they become adept in helping design modern techniques of monitoring and controlling.

- Senior officers shall do data analysis themselves. It will help in developing insights and identify patterns of non-compliance. Repeatable analytics can be automated and shifted to machines.

- WCO has already released Data Model Version 3.6.0 in May last year. It is a library of data components and electronic document templates that can be used to effectively exchange data. Besides giving data element attributes, it also gives IDs and Names of UN/TDED. All present and future developments in the system should comply with the new standard. This will not only help in developing EDIs with regulatory authorities in Pakistan but with other customs administrations.

- There are huge gaps in trade data communication within and across borders. This synergy can be capitalized with minimal costs to authorities and stakeholders.

- Currently machine based clearances are a minor portion of total trade. Selectivity criteria would run on information; distortions in data would cripple its functioning. Data cleansing exercises shall be initiated and sanctioning mechanism may be put in place to avert further distortions in the data.

- Obvious and available resources of data shall not be ignored. Information, kept in silos, and not integrated due to turf wars amongst authorities results in poor utilization of resources. FBR can proactively deal with the situation and develop system whereby information available at different formations under its control is made accessible to appropriate users and negotiate with other regulatory and enforcement authorities, like NADRA, State Bank, Provincial revenue departments, MSA, Immigration, etc for sharing data in real time.

Customs geared up to reforms and modernization in Pakistan

The reform and modernization programme was started by Pakistan Customs in 1994 when Pakistan Revenue Automation Limited (PRAL) was set up as a small ICT company associated with the Federal Board of Revenue (FBR).

It is now one of the largest ICT solution provider company in Pakistan offering business process re-engineering, software development, managing large data centers, designing and executing wide area networks, operational and technical maintenance services.

In the past, PRAL developed One Customs system for clearances of all types of international cargo such as import, export and transit, on the recommendation of FBR and its attached formations. However, the administrative set up was changed in recent past and Customs professionals were assigned the task to guide the technical resource in specifying the software requirements and to monitor the work of PRAL.

In this regard, Directorate General of Reforms & Automation (Customs) was established on August 12, 2014 with the mandate to develop new systems in the light of international best practices on the recommendation of FBR. The Directorate General is manned by Customs professionals who specify the software requirements and monitor three small teams of PRAL. The following functions are also included in its mandate:Amendment, improvement, modification or re-engineering of the existing systems on the recommendation/approval of FBR;

- Development of performance benchmarks of Customs business processes;

- Recommendation to FBR for hiring of consultants on need basis, in respect of automation or reform initiatives;

- Facilitate development of Requirement Specification for Electronic Data Interchange at the operational level;

- Facilitate design and development of Websites for field and support formations of Customs department;

- Identify the need for procurement, installation and maintenance of hardware, software and networking equipment for Customs department; and

- Facilitate the provision of technical support to the field and support formations and address all kinds of mal-functioning.

The short term policy is to create a paperless environment under the Web Based One Customs (WeBOC) system for all Customs processes to ensure an effective service delivery. The present coverage of the WeBOC system is 88 percent in terms of value and 86 percent in terms of number of Goods Declarations (the single administrative document for clearance of international cargo). The remaining cargo is cleared under the semi-automated One Customs system.

The medium term policy is to integrate all the regulatory authorities (INTRA) with the system which have to issue a certificate, document or report in connection with the clearance of any international cargo whether import, export or transit. These authorities include the federal ministries, government departments and agencies.

The long term policy is to create a national single window which will provide a platform for electronic data interchange/exchange with the international Customs organizations and other agencies.

For example, electronic exchange of certificates of origin with reference to Pak-China Free Trade Agreement is in progress. A memorandum of understanding (MoU) has been signed between Pakistan Customs and International Air Transport Association (IATA) for implementation of IATA Cargo-XML standards in the launch of new manifestation framework for the airlines operating in Pakistan and IATA Advance Passenger Information (API) exchange standards.

In 2006, Pakistan Customs started Integrated Cargo Container Control (IC3) programme that facilitates the outbound cargo by using non-intrusive detection with reduced scanning cost destined to the United States (US).

This measure also helps control illegal transportation of arms, radioactive materials and narcotics. In 2012, Pakistan Customs started Safe Transportation Environment (STE) project to manage risk of Afghan Transit (AT) cargo and to reconcile cargo data at the entry and exit points. It is taking place on real-time basis by tacking and monitoring of vehicles carrying AT cargo.

The critical requirements identified are container-vehicle synchronization, electronic geo-fencing, alert on route deviation, container door monitoring capability, route-time monitoring, un-authorized stoppage, data analysis and reporting, and option of satellite-based or hybrid (satellite + ) tracking devices with auto-switching.

The development project namely Integrated Transit Trade Management System (ITTMS) worth $316.86 million jointly funded by FBR and Asian Development Bank (ADB) has been launched for development of trade related infrastructure at border crossing stations of Torkham (Khyber Pakhtunkhwa), Chaman (Balochistan), Wahga (Punjab) and Ports of Karachi and Bin Qasim (Sindh).

The Japan International Co-operation Agency (JICA) has provided grant in aid and started a project known Gantry Type X-ray Container Inspection System for security improvement in Port Karachi and Port Muhammad Bin Qasim. For the purpose of Non-Intrusive Inspection (NII), three units of the Gantry Scanners including X-ray container inspection system shall be installed in the X-ray inspection buildings situated on these ports.

The afore-referred programs and activities clearly reflect that Pakistan has made a considerable progress regarding WCO’s SAFE Framework of Standards, Revised Kyoto Convention (RKC) and WTO’s Trade Facilitation Agreement (TFA).

Major development in this direction is five years project (Sept; 2015 to Aug; 2020) namely the Pakistan Regional Economic Integration Activity (PREIA) Project funded by the United States Agency for International Development (USAID). PREIA’s focus area is trade promotion and facilitation in collaboration with public and private sector to improve competitiveness resulting into increased volumes of trade and transit.

Inter-agency cooperation is a major problem in reform and modernization process for the reason that other government departments, ministries and agencies are not at the same stage of ICT solutions as Pakistan Customs is.

As a result, integration of any new module in the system involving other agencies is always a time consuming activity starting with preparation of a Business Requirement Document (BRD) involving lengthy discussions and deliberations followed by installation of required hardware by the respective agencies and training of the users.

The second problem is recruitment and selection of IT professionals required for analysis of business requirements, design and development of software and post deployment operations and maintenance.

The third problem is procurement of hardware including enhanced capacity servers, networking and system security equipments which are imperative at this stage.

WCO Data Model and WeBOC

The WCO (World Customs Organization) has called up on all members to further promote efforts and initiatives in a sector that is becoming key element in Customs modernization process i.e. Collecting and Analyzing data. It is in this context, that the year 2017 has been dedicated by WCO to promoting data analysis under the slogan “Data Analysis for Effective Border Management.”

- 02. The data analysis acquires criticality while making informed decisions, especially when the Customs Administrations are faced by sophisticated and evolving challenges every day. Data analysis thus can greatly support core Customs’ objectives of not only revenue collection but also border security, collection of trade statistics and boosting trade facilitation at the same time. The Data Analysis however can be well supported when there is harmonization of data which can be achieved through WCO Data Model. It would not only contribute to improvement in data collection but also enable smooth sharing of data between government and cross border agencies. Besides it will provide the platform for exchange of AEI (Advance Electronic Information) and Advance Cargo Declaration etc. Therefore adaption of WeBOC to WCO Data Model would be an important development for customs clearance process. It may be high time to learn about it.

- The Data Model prescribed by WCO (World Customs Organization) is a collection of international standards on data and information required by government agencies in relation to regulation of cross-border trade. This collection has been developed by WCO after examination of all relevant international instruments and guidelines, along with national and industry practice, with the objective of achieving a consensus on the manner in which data will be used in applying regulatory controls in global trade. The Data Model contains data elements which are logically grouped into units of meaningful information, called “information models”. These information models serve as reusable building blocks with which one can build electronic document and data exchange templates.

- Currently, there are at least three international “data models” which organize data elements and standardize how the data elements relate to one another. The first and the oldest is United Nations (UN) Trade Data Element Directory (TDED) which is closely linked to paper-based forms and contains information about location of each data element on a standard paper layout. Nonetheless, it continues to remain relevant even in the electronic environment as it provides basis for UN Electronic Data Interchange (EDI) for Administration. Second is UN/EDIFACT which comprises a set of internationally agreed standards, directories and guidelines for the electronic interchange of structured data, and in particular, that related to trade in goods and services between independent, computerized information systems. TDED helps construct UN/EDIFACT components which are commonly used in Electronic Data Interchange (EDI). Thirdly, the Core Components Library (CCL) could be said to be a further development on TDED. The WCO Data Model draws heavily from the aforesaid standards. First, it is by and large cross-referenced to TDED. Second, the WCO Data Model is also expressed through a standard UN/EDIFACT GOVCBR (Government Cross-Border Regulatory) message. Third, the modeling principles of WCO Data Model are largely similar to CCL, as both are based on Core Component Technical Specifications

- The first version 1.0 of Data Model was launched by WCO in 2001 The latest in the evolution is version 3.6.0 which has been finalized in May 2016 by WCO Data Model Project Team (DMPT). It stands as a collection of international standards on data and information required not only by Customs, but also by government agencies, developed with the objective of achieving a consensus on the manner in which data will be used in applying regulatory facilitation and controls in global trade. The latest Data Model contains data sets for different border procedures, including definitions of data elements, recommended data formats and suggested code lists. It also includes Information Packages, which are standard electronic templates linked to business processes such as Goods Declarations, Cargo Reports, Conveyance Reports, Licenses/Permits, and Certificates. It is a library of data components and electronic document templates that can be used to effectively exchange business data.

- Pakistan Customs is using WeBOC(Web based One Customs) for automated customs clearance of the goods. The system is in operation since 2011/12 and is constantly growing ever since. At present it is catering to almost all customs operations from seaports, airports, dry ports to borders; and is meeting almost all core requirements for clearance of goods including various ancillary and peripheral processes. The work on WeBOC connectivity with INTRA (Integrated Regulatory Authorities) is also actively in progress and the connectivity with some of Regulatory Authorities outside FBR has already been achieved such as EDB Quota, State bank of Pakistan and the Banks, Provincial Taxation Departments, Ministry of Climate Change and Trade Development Authority etc. Soon as the INTRA are connected to WeBOC, it would then be ready as Single Window Platform for interoperability with regional Single Windows through Electronic Data Exchange (EDE). The need for mapping WeBOC to a certain WCO Data Model in view of challenge of data harmonization that would be required while establishing EDE (Electronic Data Exchange) with regional administrations. The WCO Data Model Package resolves EDE issues as it offers standardized set for member countries to adopt.