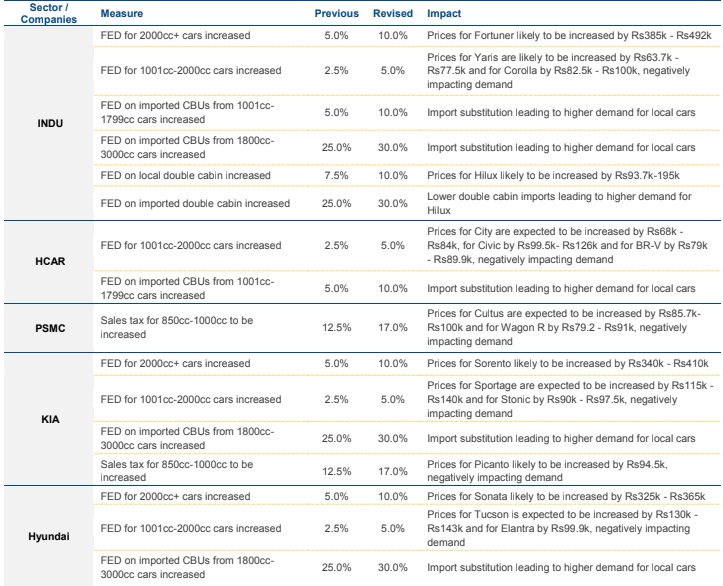

KARACHI: The mini-budget tabled before the National Assembly has proposed several taxation measures on automobile sector, which would increase car prices (both imported and locally assembled) significantly. Vehicle prices in Pakistan are likely to surge in the range of Rs65,000 to Rs500,000 depending on the variant.

Earlier, it was believed that Sales Tax on cars below 1000cc will be increased to standard 17% from 12.5% but the government maintained GST at 12.5% for cars up to 850cc while increasing the GST from 12.5% to 17% for cars between 850-1000cc.

Moreover, government also increased advance tax by 50,000 for cars up to 1000cc, 100,000 for 1000-2000cc and 200,000 on 2000cc and above categories.

Similarly, FED on 1000-2000cc and 2000cc above cars has been increased by 2.5% and 5% respectively. “Thus, we expect car prices to remain unchanged for variants below 850cc while those between 850-1000cc may increase by 4% (70-75 thousand rupees),” an analyst at Sherman Securities said.

Similarly, car prices are expected to increase by 50-100 thousand rupees (up 2.4%) in 1000-2000cc category (base case variants) and 180-400 thousand (up 4.8%) for those above 2000cc.

“Since 850-1000cc category contributes around 40% of Pak Suzuki (PSMC) total sales, we believe that the company’s volumes (mainly for Cultus and Wagon R) may take a hit”.

Besides, the government also increase FED on imported Completely Built-up Unit (CBUs) by 5% on all categories below 3000cc. This is positive for the local assemblers especially in the 1000-2000cc as their price increases will be lower (2.5%) compared to imported CBUs.