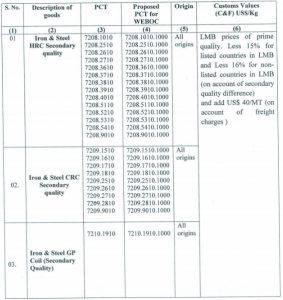

KARACHI: The Directorate of Customs Valuation has revised the customs values of HRC/CRC and GP (secondary quality) vide Valuation Ruling No.1213/2017.

Customs values of HRC/CRC/GP (Secondary quality) were earlier determined vide Valuation Ruling No.717/2015. Since these values were determined more than a year ago, and the values of subject goods were aligned with LMB prices of prime quality HRC/CRC/GP with admissible discount on basis of secondary quality.

However, some importers approached Directorate General as well as the High Court for redetermination of customs value of HRC/CRC/GP (Secondary quality) on basis of increase in discount from prime to secondary quality, reduction of freight element as provided in aforementioned Valuation Ruling and uniformity of valuation of non-listed countries from LMB.

M/s Stamco Steel Corporation filed Suit before the High Court whereby the Court disposed of suit with direction to the Directorate that plaintiff‘s application under Section 25A which is pending before the Director, Valuation Customs shall be decided within 45 day and till such time the application is decided.

Keeping in view the exhaustive exercise for re-determination of customs values, the Directorate submitted extension application before the Court which was duly allowed by the Court for further 40 working days. Therefore an exercise was initiated for redetermination of Customs values of secondary quality HRC, CRC and GP according to trends prevailing in the international market.