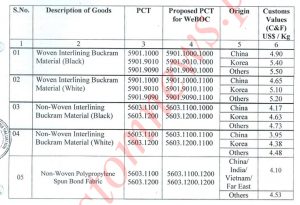

KARACHI: Director General Customs Valuation Syed Tanvir Ahmed has amended the Valuation Ruling No.926/2016 and revised the customs values of woven and non-woven interlining Buckram.

M/s Carewell Traders and others submitted that earlier, valualion ruling No.428/2012 was in vogue, whereas the department in absense of lawful justification frustrated Customs value structure of the Woven Interlining Buckram under the false and frivolous complaint of a local manufacturer.

The customs values of woven interlining buckram material (classifiable under HS Code 5901) was enhanced arbitrarily by the respondent, in absence of lawful justification, legal basis, facts and laws of the case under apparent non-bonafides for undue enrichment.

The department responded that the said Valuation Ruling was issued well within the legal framework and within the jursidiction laid down in Customs Act 1969 in sequential method on the basis of documentary evidences available on record.

The case record and return as well as verbal submission of the petitioners were examined in detail. The main contention of the petitioners was that the customs values of woven and non-woven interlining buckram material was enhanced arbitrarily by the respondent in absence of lawful justificiation.

They demanded fresh market inquiry from neutral person.Fresh market inquiry was conducted, which showed downward prices then the values determined in the valuation ruling. Local manufacturers were also consulted.

After detailed deliberation of the case, Director General Syed Tanveer Ahmed revised the customs values of interlining buckram.