KARACHI: The government on Tuesday said it has decided to close a mandatory audit and waive a Rs20,000 penalty imposed on citizens who recently filed returns for tax years preceding 2017-18.

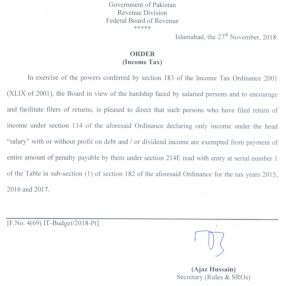

The Federal Board of Revenue had on Nov 14 issued audit notices to over a million late filers who had submitted returns for tax years 2015, 2016 and 2017. They were asked to pay a Rs20,000 penalty or higher taxes for automatic closure of audit proceedings.

The audit and penalty were imposed because the filers had submitted their returns after the expiry of the deadlines for preceding years.

The late filers were subsequently selected for audit under Section 214D of the Income Tax Ordinance. The facility for availing automatic closure of audit (after paying Rs20,000 penalty) under Section 214E was to be available till Dec 31 and approximately 1,022,000 taxpayers were eligible for it.

Minister of State for Revenue Hammad Azhar announced that the government has decided to waive the penalty and audit for late filers for preceding years as well.