KARACHI: The Federal Board of Revenue (FBR) has notified Benami Transactions (Prohibition) Rules, 2019, which would enable tax officers to provisionally attach and/or confiscate properties held in other than owners’ names.

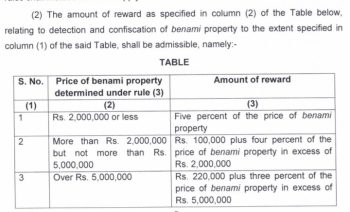

The Rules have also prescribed rewards for whistleblowers relating to detection and confiscation of Benami property, which may be as much as 5.0 percent of the value of such property.

Under the Rules, tax authorities have jurisdiction over movable and immovable property including vehicles, cash in bank accounts and investment accounts held in Benami accounts i.e. held in other than owners’ names.

The Rules define the jurisdictions of Administrator, Initiating Officer Approving Authority and Adjudication Authority pertaining to detect, investigate, and adjudicate cases of Benami Transactions and accounts.

The tax authorities have been empowered to sell the confiscated properties and issue a direction to the bank or financial institutions to transfer and credit the money to the account of the Administrator, in case the property is in the form of cash in a bank or financial institution.

The Administrator may establish one or more warehouses for safe keeping of attached and confiscated properties such as vehicles.

According to the Benami Transactions (Prohibition) Rules 2019, an appeal against the judgement of Adjudication Authority can be made at the Federal Appellate Tribunal.[the_ad id=”31605″]