KARACHI: National Electric Power Regulatory Authority (NEPRA) has convened a consultative session on November 21, 2018 to arrive at a just and informed decision as the authority is reviewing the returns offered in the power sector.

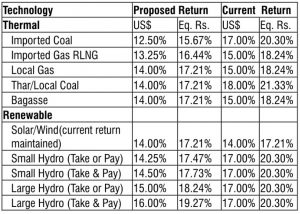

The existing generation tariff regimes of NEPRA, both upfront and cost-plus, allow for a fixed Internal Rate of Return (IRR). The IRR presently ranges in-between 15 percent and 20 percent.

“The working out of such IRR now needs to be effectively depicted against specific risk and return matrix and its adjustment for a particular technology. The IRR thus allowed should clearly spell out and be reflective of a return which has built-in approach to account for various parameters, such as; prevailing power sector incentive packages, associated country risks, variants of that particular technology, level of incentive to be created for investors and whether the investor is opting for upfront or cost plus regime,” NEPRA notes in its concept paper prepared to provide a basis for determining returns for various generation technologies.

Subsequently, the authority received several comments from individuals and firms and general public. Accordingly after reviewing input from the stakeholders while relying on the recent market data, NEPRA has proposed downward revision in the returns being offered to power sector.