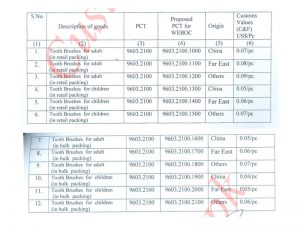

KARACHI: Director General Customs Valuation Syed Tanvir Ahmed has amended the Valuation Ruling No.901/2016 and revised and categorized the customs values of tooth brushes of all kinds.

M/s Mater Enterprises submitted that the import from Bangladesh is being subjected to discrimination besides highly unjustified rates are fixed against the class and category (other origins). It is further submitted that while issuing subject valuation ruling No. 901/2016 the issuing authority failed to pin point the issue of other origin.

Valuation authority failed to incorporate Bangladesh as separate exporting country in respect of subject valuation. The valuation ruling in absence of Bangladesh country is discriminatory in nature and against the constitutional rights provided by the law.

The imports from Bangladesh cannot be categorized in other origins being cheaper as compared to China. It is further submitted that applicant is suffering higher duty and taxes due to higher prices fixed in relation to category other origins.

After detailed deliberation of the case, Director General Syed Tanveer Ahmed revised and categorized the customs values of tooth brushes of all kinds.