KARACHI: The Director of Customs Valuation has revised the customs values of cosmetics vide Valuation Ruling No.814/2016.

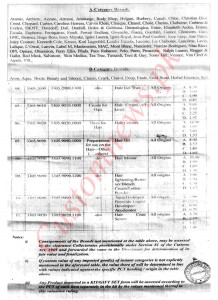

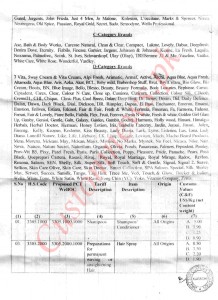

The brands have been divided into A, B, C, D categories. Accordingly the ‘A’ category brands of Talcum powder under PCT 33.04 of all origins will be assessed to duty and taxes at $3.1/KG, ‘B’ category at $2.8/KG, ‘C’ category brands at $1.34/KG, ‘D’ category brands at $1.16/KG.

‘A’ category brands of Lotions under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $3.5/KG, ‘C’ category brands at $2/KG, ‘D’ category brands at $1.51/KG.

‘A’ category brands of face skin cream/serum under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $3.5/KG, ‘C’ category brands at $2/KG, ‘D’ category brands at $1.51/KG.

‘A’ category brands of cleansing milk all kinds under PCT 33.05 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $3.5/KG, ‘C’ category brands at $2/KG, ‘D’ category brands at $1.51/KG.

‘A’ category brands of face skin cream serum (packing of 10 grams & above) under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $3.96/KG, ‘C’ category brands at $1.7/KG, ‘D’ category brands at $1.48/KG.

‘A’ category brands of face skin cream serum (packing of less than 10 grams) under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $6.36/KG, ‘C’ category brands at $3.90/KG, ‘D’ category brands at $2.5/KG.

‘A’ category brands of face skin tonic/toner/gel under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $2.77/KG, ‘C’ category brands at $1.63/KG, ‘D’ category brands at $1.45/KG.

‘A’ category brands of facial foam/mask/scrub under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $2.93/KG, ‘C’ category brands at $1.73/KG, ‘D’ category brands at $1.45/KG.

‘A’ category brands of make-up remover under PCT 33.04 of all origins will be assessed to duty and taxes at $15/KG, ‘B’ category at $2.87/KG, ‘C’ category brands at $1.78/KG, ‘D’ category brands at $1.45/KG.

‘A’ category brands of toothpaste under PCT 33.06 of all origins will be assessed to duty and taxes at $4.17/KG, ‘B’ category at $3.34/KG, ‘C’ category brands at $1.36/KG, ‘D’ category brands at $1.0/KG.

‘A’ category brands of after shave under PCT 33.07 of all origins will be assessed to duty and taxes at $35/KG, ‘B’ category at $5.84/KG, ‘C’ category brands at $3.36/KG, ‘D’ category brands at $3.0/KG.

‘A’ category brands of shaving cream under PCT 33.07 of all origins will be assessed to duty and taxes at $5.48/KG, ‘B’ category at $4.44/KG, ‘C’ category brands at $2.15/KG, ‘D’ category brands at $1.60/KG.

‘A’ category brands of shaving foam under PCT 33.07 of all origins will be assessed to duty and taxes at $4.9/KG, ‘B’ category at $4.44/KG, ‘C’ category brands at $1.59/KG, ‘D’ category brands at $1.39/KG.

‘A’ category brands of soap in liquid forms under PCT 33.01 of all origins will be assessed to duty and taxes at $1.27/KG, ‘B’ category at $1.1/KG, ‘C’ category brands at $0.90/KG, ‘D’ category brands at $0.55/KG.

‘A’ category brands of facial wash under PCT 33.01 of all origins will be assessed to duty and taxes at $4.25/KG, ‘B’ category at $3.25/KG, ‘C’ category brands at $1.50/KG, ‘D’ category brands at $1.4/KG.